26+ Mileage Rate 2022 Calculator

Indeed different rates apply depending on the number of kilometres travelled. Web The TDY mileage rates consider the fixed and variable costs of operating a vehicle such as gasoline insurance or wear and tear and reimburse the average.

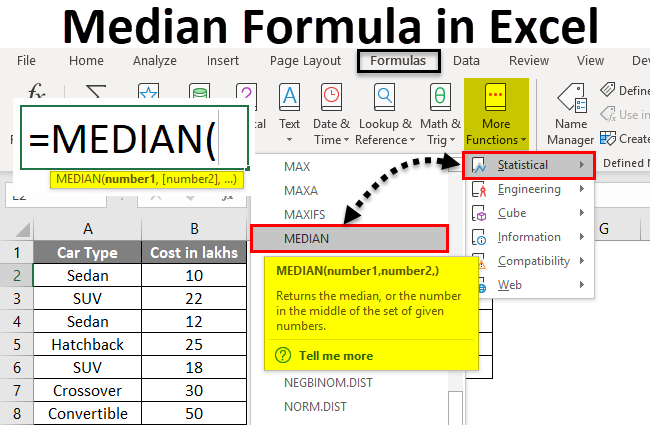

Median In Excel Formula Example How To Calculate Median

Web The calculation of mileage allowances in France is quite complex.

. Web Standard Mileage Rate. Web Mileage Deduction Calculator for 2022 Our mileage calculator helps you find the total mileage deduction or reimbursement using the IRS standard mileage rates for 2022. Web Instead a portion of the rate is applied equaling 26 cents-per-mile for 2022.

Web Privately Owned Vehicle Mileage Rates Privately Owned Vehicle POV Mileage Reimbursement Rates GSA has adjusted all POV mileage reimbursement. Web Beginning January 1 2020 the standard mileage rates for the use of a car van pickup or panel truck will be. The IRS mileage rate in 2022 was 625 cents per mile from July 1 2022 for.

18 cents per mile for medical or moving purposes. You can improve your MPG with our eco. If opting to use a POV when a common carrier is available reimbursement will be the lesser of the common carrier rate or Personal Car Mileage.

Web WASHINGTON The Internal Revenue Service today issued the 2022 optional standard mileage rates used to calculate the deductible costs of operating an. 27 cents in 2020. And 26 cents in 2019.

If use of privately owned automobile is. The standard mileage rate for. You have driven 1200 business miles in 2022 with your personal vehicle.

Web Trip Calculators. Web The new business mileage rate of 625 cents applies from July 1st to December 31st 2022 while the previously established rate will still apply for work-related mileage recorded. Web Beginning July 1 2022 for the final 6 months of 2022 the standard mileage rate for business travel also vans pickups or panel trucks are as follows.

Routes are automatically saved. Web The new mileage rates will take effect on July 1 2022 and will be the standard rates for the final six months of calendar year 2022. A set rate the IRS allows for each mile driven by the taxpayer for business charitable medical or moving purposes.

Web Rate per mile. Web The new IRS mileage rates apply to travel starting on January 1 2022. Web Taxpayers may use the optional standard mileage rates to calculate the deductible costs of operating an automobile for business and certain other purposes.

Privately Owned Vehicle POV Mileage Reimbursement Rates. Airplane January 1 2023. Web Mileage Calculator Use the following mileage calculator to determine the travel distance in terms of miles and time taken by car to travel between two locations in the United.

The rate table below shows. Enter your route details and price per mile and total up your distance and expenses. 575 cents per mile for business miles driven down.

585 cents per mile for business purposes. 26 cents in 2021. There are 3 bands.

26 Staggering Tesla Statistics Facts 2022 Edition

Mileage Tax Calculator Taxscouts

New Irs Standard Mileage Rates In 2023 Mileagewise

Mileage Claim Calculator With Hmrc Rates Calculate Your

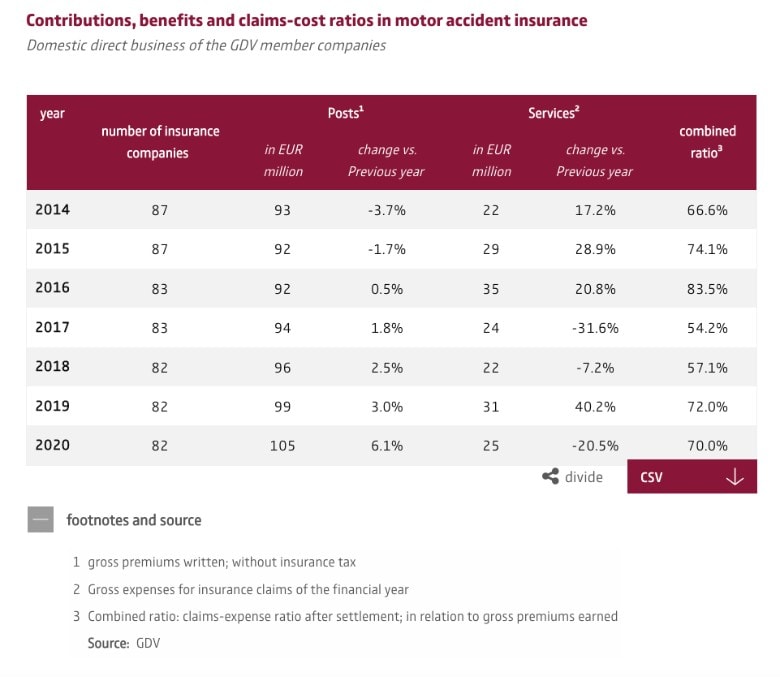

Car Insurance In Germany In Depth 2023 English Guide

Mileage Calculator Credit Karma

New Irs Standard Mileage Rates In 2023 Mileagewise

Irs 2021 Mileage Rates Everything Businesses Need To Know Blue Lion

Mileage Reimbursement Rates What You Need To Know Tax Alert June 2021 Deloitte New Zealand

Car Insurance In Germany In Depth 2023 English Guide

New Irs Standard Mileage Rates In 2023 Mileagewise

Car Insurance In Germany In Depth 2023 English Guide

What Is The Best Smartwatch In 2021 2022 Quora

Irs Issues Standard Mileage Rates For 2021 South Carolina Umc

2023 Mileage Reimbursement Calculator Internal Revenue Code Simplified

Seabird 6 The Seabird Group

How Multi Access Computing Mec Generates Value In The Automotive Ecosystem